5 Percent Cash Back and 0 Percent Transfer Credit Card

All information about the Navy Federal Credit Union Platinum card, the Wells Fargo Cash Wise Visa® card and Wells Fargo Platinum card has been collected independently by CreditCards.com. The issuer did not provide the content, nor is it responsible for its accuracy. The Wells Fargo Platinum card is no longer available.

A guide to zero interest credit cards

Using a credit card to pay down a balance over time can be convenient, but there is a trade-off: interest charges. Interest is the fee you pay for borrowing money, usually expressed as a percentage of your balance.

You can avoid interest entirely if you pay your balance in full each month. But with a zero-interest credit card, you get the ability to split up payments over a certain amount of time without accruing interest charges. These credit cards will typically offer new cardholders a 0% introductory APR period – usually 12 months or longer – when new purchases or even balance transfers accumulate no interest.

The best 0% intro APR credit cards compared

| Credit card | Best for: | 0% intro APR | Regular APR | CreditCards.com Rating |

|---|---|---|---|---|

| Wells Fargo Reflect℠ Card | Best for longest intro APR | Up to 21 months on purchases from account opening and qualifying balance transfers made within 120 days from account opening if you make on-time monthly minimum payments for the full length of the offer | 12.99% to 24.99% Variable | 4.1 / 5 |

| BankAmericard® credit card | Ongoing low APR | 18 billing cycles On balance transfers made in the first 60 days and new purchases. A 3% fee (minimum $10) applies to all balance transfers | 12.99% – 22.99% Variable | 4.4 / 5 |

| U.S. Bank Visa® Platinum Card | Large purchases | First 20 billing cycles On purchases and balance transfers | 14.49% to 24.49% Variable | 4.2 / 5 |

| Discover it® Cash Back | Rotating category rewards | 14 months On balance transfers and new purchases | 11.99% – 22.99% Variable | 4.5 / 5 |

| Citi Custom Cash℠ Card | 0% introductory APR on purchases + cash back | 15 months On purchases and balance transfers | 13.99% to 23.99% Variable | 4.1 / 5 |

| Wells Fargo Active Cash℠ Card | Cellphone protection | 15 months from account opening on qualifying balance transfers made in the first 120 days as well as purchases | 14.99% – 24.99% Variable | 3.7 / 5 |

| Chase Freedom Unlimited® | 0% intro APR and rewards | 15 months On purchases | 14.99% – 24.74% Variable | 4.8 / 5 |

| Bank of America® Customized Cash Rewards credit card | Flexible cash back categories | 15 billing cycles On balance transfers made in the first 60 days and new purchases. A 3% fee (minimum $10) applies to all balance transfers. | 13.99% – 23.99% Variable | 4.2 / 5 |

| Citi® Diamond Preferred® Card | Balance transfer | 12 months on purchases and 21 months on balance transfers On balance transfers completed within the first 4 months of account opening | 13.74% – 23.74% Variable | 3.6 / 5 |

| Bank of America® Unlimited Cash Rewards credit card | Unlimited cash back for Preferred Rewards members | 15 billing cycles On balance transfers made in the first 60 days and new purchases. A 3% fee (minimum $10) applies to all balance transfers. | 13.99% – 23.99% Variable | 3.3 / 5 |

| Blue Cash Everyday® Card from American Express | Good credit | 15 months On new purchases | 13.99% – 23.99% Variable | 3.4 / 5 |

| Capital One Quicksilver Cash Rewards Credit Card | No annual fee | 15 months On new purchases and balance transfers | 14.99% – 24.99% Variable | 3.1 / 5 |

| Discover it® Balance Transfer | High rewards rate + introductory bonus | 18 months On balance transfers | 11.99% – 22.99% Variable | 4.5 / 5 |

| Citi Simplicity® Card | 0% intro APR + low fees | 12 months on purchases and 21 months on balance transfers On balance transfers completed within the first four months of account opening | 14.74%-24.74% variable | 3.6 / 5 |

| Citi® Double Cash Card | Cash back | 18 months On balance transfers | 13.99% – 23.99% Variable | 3.6 / 5 |

Editor's picks: Zero interest credit card details

Wells Fargo Reflect℠ Card: Best for longest intro APR

Why we picked it: This is the one of the longest 0% introductory APR offers on purchases and qualifying balance transfers on the market (up to 21 months from account opening, then 12.99% to 24.99% variable APR).

Pros: The promotional APR offer extends to both purchases and qualified balance transfers. While you won't get traditional rewards, you will receive cellphone protection (up to $600 with a $25 deductible) and access to My Wells Fargo Deals.

Cons: There's some fine print associated with the promotional APR offer. For starters, you get 18 months from account opening of a 0% intro APR on purchases and qualifying balance transfers (then variable 12.99% to 24.99% APR) with the option of qualifying for an extension of up to three months with on-time minimum payments. Plus, if you don't transfer a balance over in 120 days of account opening, you won't qualify for the intro rate and you'll face a hefty balance transfer fee (5% or $5, whichever is greater).

Who should apply? If you suspect you'll need an extra-long window to pay off a large purchase or a qualifying balance transfer, this card should be top of mind. Just be sure to transfer any applicable balances within 120 days of account opening to qualify for the intro rate and the 3% balance transfer fee ($5 minimum).

Who should skip? If you're looking for versatility and long-term value, look elsewhere for a card that offers a 0% intro APR and has a rewards program or generous cardholder perks.

Related: Wells Fargo Reflect benefits

Read our Wells Fargo Reflect℠ Card review or jump back to this card's offer details.

BankAmericard® credit card: Best for low ongoing APR

Why we picked it: With this card, you'll have 18 billing cycles to take advantage of a 0% introductory APR on both balance transfers made within the first 60 days and purchases. After that, your regular APR ranges from 12.99% to 22.99% variable.

Pros: The low regular APR and lack of an annual fee make this card more valuable than the average 0% intro APR card.

Cons: The balance transfer fee is a standard 3%, with a $10 minimum.

Who should apply? Someone with a lot of debt or who plans to make a large purchase and wants to pay it off over an extended period without any interest charges. This card is also potentially a fit for someone with good credit who is hoping for a low(ish) go-to APR once the intro period expires.

Who should skip? Rewards seekers who want a credit card that earns rewards and has a 0% intro period.

Related: Is the BankAmericard credit card worth it?

Read our full BankAmericard credit card review or jump back to this card's offer details.

U.S. Bank Visa® Platinum Card: Best for large purchases

Why we picked it: If you're planning to finance a large purchase, this card is one of the best options on the market with its long introductory interest rate on purchases as well as a lengthy intro period on balance transfers.

Pros: Cardholders receive a full 20 billing cycles before they start accruing interest on new purchases (14.49% to 24.49% variable APR thereafter). This card has no annual fee and offers cellphone protection (coverage of up to $600, with a $25 deductible) in the case of covered damage or theft when you pay your cellphone bill with this card.

Cons: This card has limited long-term value as it does not offer a rewards program. The card also charges a fee of up to $40 for late payments and 2% to 3% on each foreign transaction you make (2% if the transaction is in U.S. dollars, 3% if in a foreign currency).

Who should apply? Anyone seeking a significant amount of time to pay down new purchases interest-free.

Who should skip? Someone looking for rewards or a sign-up bonus.

Read our U.S. Bank Visa® Platinum Card review or jump back to this card's offer details.

Discover it® Cash Back: Best for rotating category rewards

Why we picked it: One of the best rewards credit cards on the market, the Discover it Cash Back also touts a 0% intro APR for 14 months on new purchases and balance transfers (11.99% to 22.99% variable after that). Read more and see how our expert, Ana Staples, uses the Discover It Cash Back card.

Pros: You earn 5% cash back on the first $1,500 you spend in rotating bonus categories each quarter (upon activation, then 1%) and Discover matches your cash back at the end of your first year. The bonus categories for Q4 (Oct. 1 through Dec. 31, 2021) include Amazon.com, Target.com, and Walmart.com.

Cons: There is a 3% intro balance transfer fee (up to 5% fee on future balance transfers).

Who should apply? Someone looking for a credit card with well-rounded benefits, including an intro APR on purchases or balance transfers, a potentially low go-to APR and a competitive cash back rewards program.

Who should skip? This isn't for people who are more focused on paying off debt and don't want to deal with the hassle of constantly enrolling in rewards categories to earn this card's full potential.

Related: Discover it Cash Back rewards and benefits guide

Read our full Discover it Cash Back review or jump back to this card's offer details.

Citi Custom Cash℠ Card: Best for 0% introductory APR on purchases + cash back

Why we picked it: This cash back card from Citi offers competitive base rewards, a lucrative sign-up bonus and a lengthy promotional APR on purchases and balance transfers (0% for 15 months, then variable 13.99% to 23.99%) – all for no annual fee.

Pros: You earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent (after that, 1% cash back). Top eligible categories include restaurants, gas stations, grocery stores, select travel, select transit and select streaming services. You don't even have to enroll or track your spending; your earnings adjust automatically each billing cycle. You can also earn $200 in ThankYou points (redeemable as cash back) if you spend $750 within three months of account opening.

Cons: You'll pay a steep 5% fee for balance transfers (or $5, whichever is greater). There's a cap on your 5% cash back (up to $500 each billing cycle in your top spending category), which obviously eats into the card's value.

Who should apply? If you're looking to make a big purchase that will take you some time to pay off, but ultimately want a card that offers rewards, this Citi card is a great option.

Who should skip? Anyone who wants to take advantage of high rewards rates in multiple categories and big spenders who have no trouble spending more than $500 each billing cycle in top spending categories.

Related: Is the Citi Custom Cash Card worth it?

Read our Citi Custom Cash Card review or jump back to this card's offer details.

Wells Fargo Active Cash℠ Card: Best for versatility and long-term value

Why we picked it: This flat-rate cash rewards card just about has it all – a variety of redemption options, generous sign-up bonus, and no annual fee. In addition to the unlimited 2% cash rewards on eligible everyday spending, members also enjoy a long 0% introductory APR period for 15 months from account opening, and that applies to both qualifying balance transfers made in the first 120 days as well as purchases (14.99% to 24.99% variable APR thereafter).

Pros: Cash rewards never expire so long as your account remains in good standing. Card perks also include cellphone insurance and Visa Signature Concierge benefits 24 hours a day.

Cons: Depending on spending habits, some may be better served by a card that allows you to maximize earnings in specific categories. It's also important to note that the 0% intro APR on qualifying balance transfers must be made within the first 120 days as a cardholder to receive the special intro rate. There's also a balance transfer fee of 3% if you transfer the balance within 120 days; 5% if you don't (with a $5 minimum).

Who should apply? Anyone looking for an all-around cash rewards card that will provide value long after the intro APR offer has run out.

Who should skip? Rewards seekers looking to earn higher rewards rates in select spending categories.

Read our Wells Fargo Active Cash℠ Card review or jump back to this card's offer details.

Chase Freedom Unlimited®: Best for 0% intro APR with rewards

Why we picked it: Cardholders will enjoy the sign-up bonus, generous rewards program and 0% intro APR for 15 months on purchases and balance transfers (14.99% to 24.74% variable rate after introductory period). Learn how our expert, Barri Segal, uses the Chase Freedom Unlimited card.

Pros: This card gives you 5% cash back on travel purchased through Chase Ultimate Rewards; 5% cash back on Lyft purchases (through March 2022); 5% cash back on grocery store purchases (not including Target® or Walmart® purchases) on up to $12,000 spent in the first year; 3% cash back on dining and drugstore purchases; and 1.5% cash back on general purchases. Plus, there's a sign-up bonus on this card of $200 after a low $500 spend within the first three months.

Cons: There's a 3% foreign transaction fee.

Who should apply? Someone looking for an intro APR on purchases who is also hoping to secure a competitive sign-up bonus. (Note: Remember to pay any balances off in full before the introductory period expires. Otherwise, you'll ultimately lose those bonus rewards to interest).

Who should skip? Anyone looking to travel or shop internationally will be disappointed by the 3% foreign transaction fee.

Related: What credit score is needed for the Chase Freedom Unlimited card?

Read our full Chase Freedom Unlimited review or jump back to this card's offer details.

Bank of America® Customized Cash Rewards credit card: Best for flexible cash back categories

Why we picked it: This card offers a $200 online cash rewards sign-up bonus when you spend $1,000 within the first 90 days. New cardholders can also take advantage of a 0% introductory APR that lasts for 15 billing cycles on purchases and for any balance transfers made in the first 60 days (after that it's 13.99% to 23.99% variable).

Pros: Choose one of six valuable categories each calendar month for 3% cash back: gas, online shopping, dining, travel, drug stores or home improvement/furnishings. Plus, you'll also earn 2% cash back at grocery stores and wholesale clubs (up to the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter, then earn 1%).

Cons: Keep in mind that any balance transfers will be subject to a fee of 3% ($10 minimum).

Who should apply? Someone looking for an intro APR on purchases or balance transfers who is also looking for a cash back credit card that offers bonus rewards on everyday spending, once they've paid their balances down.

Who should skip? The $2,500 quarterly spending cap for the 2% and 3% combined categories may not be enough for big spenders.

Related: Bank of America Customized Cash Rewards benefits guide

Read our full Bank of America Cash Rewards credit card review or jump back to this card's offer details.

Citi® Diamond Preferred® Card: Best for balance transfer

Why we picked it: If paying off debt is your top priority and you have good or excellent credit, the Citi Diamond Preferred Card could be a lifesaver. The card comes with an extremely long introductory APR offer on balance transfers completed within the first 4 months, after which your APR is a relatively low 13.74% to 23.74% (variable). Want to learn more? See how our expert, Emily Sherman, uses the Citi Diamond Preferred card.

Pros: There's no annual fee. Plus, cardholders enjoy certain Citi benefits, including Citi Entertainment, Citi Easy Deals and Citi Flex Plan.

Cons: The lack of a base rewards program limits this card's long-term value. There's a balance transfer fee of 5% of your balance or $5, whichever is higher.

Who should apply? Someone focused on paying off debt and who isn't looking for a rewards credit card that offers cash back, points or miles.

Who should skip? This card isn't for you if you want a card that offers rewards along with a 0% intro APR. And with a 5% balance transfer fee, anyone with a lot of debt looking to save as much money as possible should take a hard pass until they've looked into cards with lower transfer fees or even no transfer fees.

Related: Is the Citi Diamond Preferred Card worth it?

Read our full Citi Diamond Preferred Card review or jump back to this card's offer details.

Bank of America® Unlimited Cash Rewards credit card: Best unlimited cash back for Preferred Rewards members

Why we picked it: This flat-rate card offers both versatility and value. You'll earn unlimited 1.5% cash back on all eligible purchases and have a 0% intro APR on balance transfers made in the first 60 days and purchases for 15 billing cycles (then 13.99% to 23.99% variable APR). Existing Bank of America Preferred Rewards members stand to earn even more with an additional 25% to 75% boost on cash back rewards (the value of the boost varies based on the amount in your eligible Bank of America accounts). Also worth noting: Cardmembers receive a $200 online cash rewards bonus after spending $1,000 within the first 90 days of account opening.

Pros: Cash rewards don't expire as long as your account remains in good standing and can be redeemed for statement credits, deposits made directly to your Bank of America checking or savings account or as a credit to an eligible Merrill account.

Cons: Carry a balance beyond the introductory 15-billing-cycle period and you could wind up paying quite a bit in interest, especially if you fall under the higher APR range. Some folks may be better served by a card that offers a high rewards rate on bonus categories aligned with their spending habits.

Who should apply? This unlimited flat-rate card has broad appeal, but existing Bank of America account holders can take advantage of the additional 25% to 75% boost on cash back rewards.

Who should skip? Anything less than 2% cash back on eligible purchases might be a disappointment to rewards seekers looking to capitalize on credit card perks.

Read our full Bank of America® Unlimited Cash Rewards credit card review or jump back to this card's offer details.

Blue Cash Everyday® Card from American Express: Best for good credit

Why we picked it: There's a 0% intro APR on purchases (15 months, then 13.99% to 23.99% variable) and an introductory bonus of a $200 statement credit after spending $2,000 in purchases within the first six months of account opening. Read about how our expert, Ana Staples, uses the Blue Cash Everyday card.

Pros: You'll enjoy an impressive cash back rewards program for no annual fee. That includes 3% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%); 2% cash back at U.S. gas stations and select U.S. department stores; and 1% cash back on general purchases.

Cons: There is no 0% intro APR balance transfer offer.

Who should apply? Someone with good credit who is about to make a large purchase they'll need some time to pay off and who ultimately wants to earn rewards on everyday expenses.

Who should skip? The lack of an intro APR for balance transfers makes this a no-go for people looking to pay down debt.

Related: Blue Cash Everyday Card from Amex rewards and benefits guide

Read our full Blue Cash Everyday Card from American Express review or jump back to this card's offer details.

Capital One Quicksilver Cash Rewards Credit Card: Best for no annual fee

Why we picked it: Not only does this card have no annual fee, it also has a decent 0% intro APR on purchases and balance transfers of 15 months. This means you can pay off purchases or pay down debt without paying interest throughout 2021; it's 14.99% to 24.99% variable after that. Learn more and see how our expert, Ana Staples, uses the Capital One Quicksilver Cash Rewards card.

Pros: Cardholders earn 1.5% cash back on all purchases. They can also earn $200 after a $500 spend within the first 3 months.

Cons: The additional benefits this card offers are lackluster compared to some other cash back cards.

Who should consider this card? Someone looking for an intro APR offer who ultimately wants to earn cash back without having to think too hard about their card's rewards program.

Who should skip? Anyone looking to earn higher rewards in specific categories will be out of luck.

Related: Is the Capital One Quicksilver Cash Rewards card worth it?

Read our full Capital One Quicksilver Cash Rewards Credit Card review or jump back to this card's offer details.

Discover it® Balance Transfer: Best for high rewards rate + introductory bonus

Why we picked it: Cardmembers can make use of its lengthy 18-month 0% intro APR for balance transfers, plus a six-month 0% intro APR on purchases (11.99% to 22.99% variable APR after that). But what really stands out here are the card's high rewards rate and Unlimited Cashback Match.

Pros: Earn 5% cash back on rotating categories like grocery stores, restaurants and gas stations up to the card's quarterly max, then receive an unlimited 1% cash back after (activation required).

Cons: The purchase APR period isn't very long compared to what's offered by similar cards.

Who should apply? Anyone looking for a balance transfer card they can stick with long after paying down the debt will find a lot to like about the Discover it® Balance Transfer, including a high rewards rate and excellent first-year bonus.

Who should skip? Anyone who needs a 0% intro APR offer on purchases that lasts longer than six months.

Read our full Discover it® Balance Transfer review or jump back to this card's offer details.

Citi Simplicity® Card: Best for 0% intro APR + low fees

Why we picked it: This no-frills credit card will appeal to people looking for a lengthy 0% intro APR (12 months on purchases and 21 months on balance transfers completed within the first four months then 14.74% to 24.74% variable APR thereafter) and consumer-friendly fee structure.

Pros: This is one of the only cards on the market that lets you avoid late payment fees and a penalty APR for the long haul. The lack of rewards could be a boon if you want to focus solely on paying down transferred balances or a large purchase. (Note: Late payments will still hurt your credit score and are best avoided.)

Cons: You'll pay a balance transfer fee of 5% or $5 of each transferred balance, whichever is greater. The lack of a rewards program is a drawback if you're looking to earn points, miles or cash back once you're done paying down your debt or large purchase.

Who should apply? If you want to avoid interest in the short term and certain fees in the long term, the Citi Simplicity fits the bill.

Who should skip? If you have debt to pay off, make sure to look around and compare options before settling for a card with no rewards program and a 5% balance transfer fee.

Related: Citi Simplicity vs. Discover it Balance Transfer

Read our full Citi Simplicity® Card review or jump back to this card's offer details.

Citi® Double Cash Card: Best for cash back

Why we picked it: You'll pay 0% interest for the first 18 months on balance transfers, after which the APR is 13.99% to 23.99% (variable).

Pros: One of our favorite flat-rate cash back cards, the Citi Double Cash Card offers 1% cash back on general purchases and 1% cash back as you pay those purchases back. There's no annual fee.

Cons: The intro balance transfer fee for new cardmembers is either $5 or 3% of the amount of each transfer, whichever is greater, for balance transfers completed within the first 4 months of account opening. There is no 0% intro APR offer for purchases.

Who should apply? Someone looking for a credit card that could bolster their financial health via a long balance transfer offer and encourage long-term responsible spending habits, given the card rewards paying down your balances.

Who should skip? Anyone looking for a 0% intro APR offer on purchases.

Related: Is the Citi Double Cash card worth it?

Read our full Citi Double Cash Card review or jump back to this card's offer details.

What are zero interest credit cards?

Zero-interest credit cards give you time to pay for new purchases or pay down existing credit card debt without having to worry about interest charges for a set period of time. Once the introductory zero-interest period ends, the go-to interest rate will apply.

If you pay your credit card bill in full each month, you won't pay any interest charges. But that is a luxury that not everyone can afford. U.S. adults with a credit report and Social Security number have, on average, $1,621 in credit card debt per account, according to the Federal Reserve Bank of New York.

Of the offers featured on CreditCards.com, the average 0% intro APR for purchases is 13.3 months. Balance transfer offers with 0% intro APR average about 14 months but can go as high as 21 months. Zero interest cards usually require good or excellent credit. Keep in mind, you must still make your minimum monthly payments during the 0% intro APR period. Otherwise, the issuer will report a missed payment to the credit bureaus and the account will ultimately go into default. Plus, you'll incur fees and, in most cases, lose access to the 0% introductory APR offer.

How do 0% intro APR credit cards work?

Each 0% introductory offer is different, but here's what you need to know when evaluating 0% APR credit cards:

- Zero percent intro offers are usually only for new applicants. If you've already had a specific credit card for years when you find out about a new 0% intro offer, chances are you won't qualify.

- Some zero percent intro offers are only for balance transfers. With balance transfers, the 0% intro APR offer is usually only valid for balance transfers made within a short period of time after you open the account, such as 60 days. Sometimes you can transfer balances from multiple cards. You'll usually have to pay a fee for transferring a balance, typically 3% to 5% of the transfer amount. If you still have a balance when the intro APR period is over, the ongoing APR will apply to whatever the current balance is.

- Some zero percent intro offers are only for purchases. You can carry a balance from month to month without accumulating any interest until your intro period is over. Once that period ends, any balance remaining on your card will accrue interest. As a reminder, you must still make at least your monthly minimum payments during the intro period.

Pros and cons of 0% APR credit cards

Pros

- You'll save on interest if you pay your balance transfer or purchases down during the promotional APR period.

- Zero percent introductory APR cards rarely charge an annual fee.

- Paying off debt via a balance transfer on a 0% introductory APR credit card can improve your credit score in the long term by decreasing your credit utilization rate.

Cons

- You could face a high interest rate once the promotional APR expires.

- You'll likely pay a fee for balance transfers.

- Balance transfers or large purchases on a 0% intro APR card can ding your credit score in the short term by increasing your single-card credit utilization rate and generating a hard inquiry.

How to choose an introductory APR credit card

Who should get a 0% intro APR credit card?

- The plan-ahead spender. Whether you want to finance home improvements or a dream vacation, a card with a lengthy 0% intro APR period can give you time to pay off your big purchase (typically 12 to 18 months) without incurring interest charges.

- The balance reducer. If you are carrying high-interest credit card debt, you can transfer it to a credit card offering a 0% introductory APR on balance transfers. This gives you a window to make progress on reducing the debt itself, but be mindful of potential balance transfer fees.

Who should skip a 0% intro APR credit card?

- The rewards seeker. While some 0% intro APR credit cards do offer rewards, you can usually find more lucrative programs attached to traditional or premium rewards credit cards.

- The payment procrastinator. The 0% interest only lasts for the duration of the introductory period, and once it ends, the card will revert to its regular APR, which may not be low (based on your creditworthiness). If you tend to carry a balance month to month, a low interest credit card could be a better option.

For more help finding a card that suits your needs, check out our guide on how to choose a 0% intro APR credit card.

How to make the most of your zero interest intro APR

- Transfer existing, high-interest debt. Chipping away at credit card debt is a good thing, but it's even better to do so without paying interest charges. For example, say you're currently carrying a $2,000 balance on a credit card with a 16% APR and you're making $60 monthly payments. You can expect to pay that balance off in 45 months and pay $662.73 in total interest. If you transfer your balance to, say, the BankAmericard® credit card, you could expect to pay that balance off in 37 months and pay $212.51 in interest. Why? Because this card offers a 0% Intro APR for 18 billing cycles for any balance transfers made in the first 60 days (12.99% to 22.99% variable APR thereafter) at 3% fee (min. $10). That means you can pay the balance back 8 months sooner and save $450.22 in interest.

- Plan large purchases ahead of time. Do you have a home improvement project on the horizon? What about a car repair or vacation? If you have a large purchase planned, taking advantage of a 0% intro purchase APR offer can reduce some of the financial strain.

- Make sure your balance is as close to zero as possible when the intro period ends. Any balance that you still owe at the end of your 0% intro period will be subject to interest charges, even if you made the purchases before the intro period ended. For instance, let's say you charged $5,000 to a zero percent interest credit card, but are only able to pay off $2,000 before the 0% introductory offer expires. If that card then carries a 22% APR and you start making $500 monthly payments, it'll take you another 7 months to pay off the balance and you'll pay $208.34 in interest.

Poll: Many Americans say they'll decrease their holiday spending in 2021

Spending money during the holiday season is an essential reality for many people. But according to a new CreditCards.com poll, about 1 in 5 Americans (21%) plan on forking over less than they did in 2020, while almost half (48%) said they will spend approximately the same and some (13%) will spend even more.

On the other hand, Ted Rossman, senior industry analyst for CreditCards.com, said there's often a disconnect between what people say they're going to do and what they actually do, which we have seen in recent consumer sentiment and spending data. Despite concerns about inflation and supply chain disruptions, Mastercard is projecting holiday sales will be 7.4% higher this year than last, and Deloitte is forecasting an increase of 7% to 9%. Last year, U.S. consumers spent a record $789.4 billion on the holidays, according to the National Retail Federation, and that was 8.3% higher than in 2019.

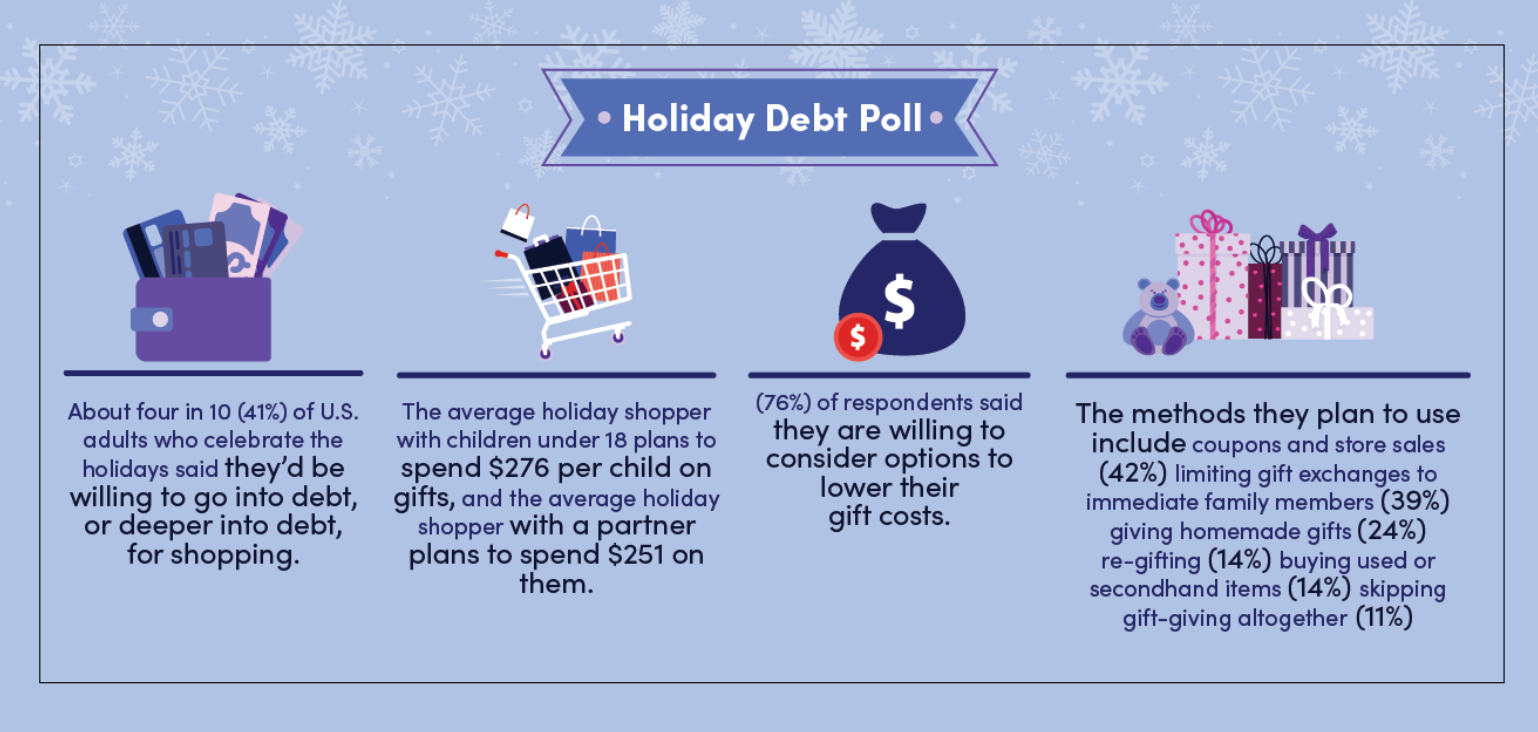

The fact of the matter is that holiday spending is a time-tested tradition that many aren't willing to break. When faced with tempting holiday sales, inflated prices and the propensity to self-gift, many Americans will end up overspending and accumulating serious debt. In fact, about 4 in 10 (41%) of U.S. adults who celebrate the holidays said they'd be willing to go into debt, or deeper into debt, for shopping. Of those cardholders who already have credit card debt, more than half (60%) said they would add to it for the holidays.

However, it's not too late to plan for your upcoming spending and rethink the way you give so you can start off the new year on the right track financially.

- Consider creating a holiday budget and limit the amount of people you buy gifts for.

- Look for alternative methods to save on your gifts by using credit card rewards or using coupons, sales promos and browser extensions like Honey, Rakuten or Capital One Shopping for additional online savings.

- Apply for a card with a 0% intro offer on purchases to give you more time to pay for the things you buy without accruing interest charges.

Read more about the results of this survey here.

How we picked the best 0% intro APR credit cards

Research methodology: We analyzed over 1,000 zero interest intro APR credit cards to identify some of the best offers on the market. The major factors we considered were:

- 0% intro APR period for purchases: Does the card allow you to skip interest charges on purchases for a set period of time? If so, how long does the offer last?

- 0% intro APR period for balance transfers: Does the card allow you to skip interest charges on a balance transfer for a set period of time? If so, how long does the offer last?

- Regular APRs: After the introductory period expires, are the purchase APRs or balance transfer APRs reasonable, relative to the current industry average?

- Balance transfer fee: Do you have to pay a fee to transfer a balance onto the new card to take advantage of the zero percent offer? If so, is the fee reasonable relative to the industry standard?

- Overall card value: Does the card offer benefits once the introductory 0% APR offer ends? For no-frills cards, we considered whether continued use would cost cardholders an annual fee.

Other criteria used include other rates and fees, rewards rates, extra benefits and features, customer service, credit needed, ease of application and security features.

Additional information on 0% APR credit cards

For more information on all things 0% APR cards, continue reading content from our credit card experts:

- What is an intro APR and how does it work?

- Average credit cards interest rates

- What is deferred interest?

- What is a good APR for a credit card?

Tracy Stewart

Tracy Stewart is a personal finance writer specializing in credit card loyalty programs, travel benefits, and consumer protections. He previously covered travel rewards credit cards, budget travel, and aviation news at SmarterTravel Media. His money-saving tips have appeared in the Washington Post, the Wall Street Journal, Consumer Reports, MarketWatch, Vice, People, the Zoe Report and elsewhere.

About the Editor

Jeanine Skowronski

Jeanine Skowronski is a credit card expert, analyst, and multimedia journalist with over 10 years of experience covering business and personal finance. She has previously served as the Head of Content at Policygenius, Executive Editor of Credit.com, Deputy Editor at American Banker, Staff Reporter at TheStreet and a columnist for Inc. Magazine.

About the Reviewer

Ted Rossman

Ted Rossman is the senior industry analyst at CreditCards.com. He has spent the past decade in the personal finance industry, conducting consumer and industry research and providing commentary for media and consumers. His focus areas include credit cards, debt management and credit scores. Ted regularly shares his advice via major media outlets such as Good Morning America, the Wall Street Journal, CNBC and Fox Business. He also writes the weekly "Wealth and Wants" column for CreditCards.com, which primarily covers cash back credit cards.

5 Percent Cash Back and 0 Percent Transfer Credit Card

Source: https://www.creditcards.com/zero-interest/

0 Response to "5 Percent Cash Back and 0 Percent Transfer Credit Card"

Publicar un comentario